|

Treasurer Gina Brettnacher 2 E Washington St. STE 204 • Frankfort , IN 46041 Phone:765-659-6325 • Fax:765-659-6391 Mon-Fri 8:00AM - 4:00PM gbrettnacher@clintonco.com |

|

Pay Taxes OnlinePay your property taxes online Tax or Certificate Sale Information - Sept. 18, 2024Lists available in the Treasurer´s office or online at GUTS Tax Sale Certificate Sale. Property Tax InformationReview all Public Property Tax Information through Data PitStop. Clinton County Property Tax For 2025

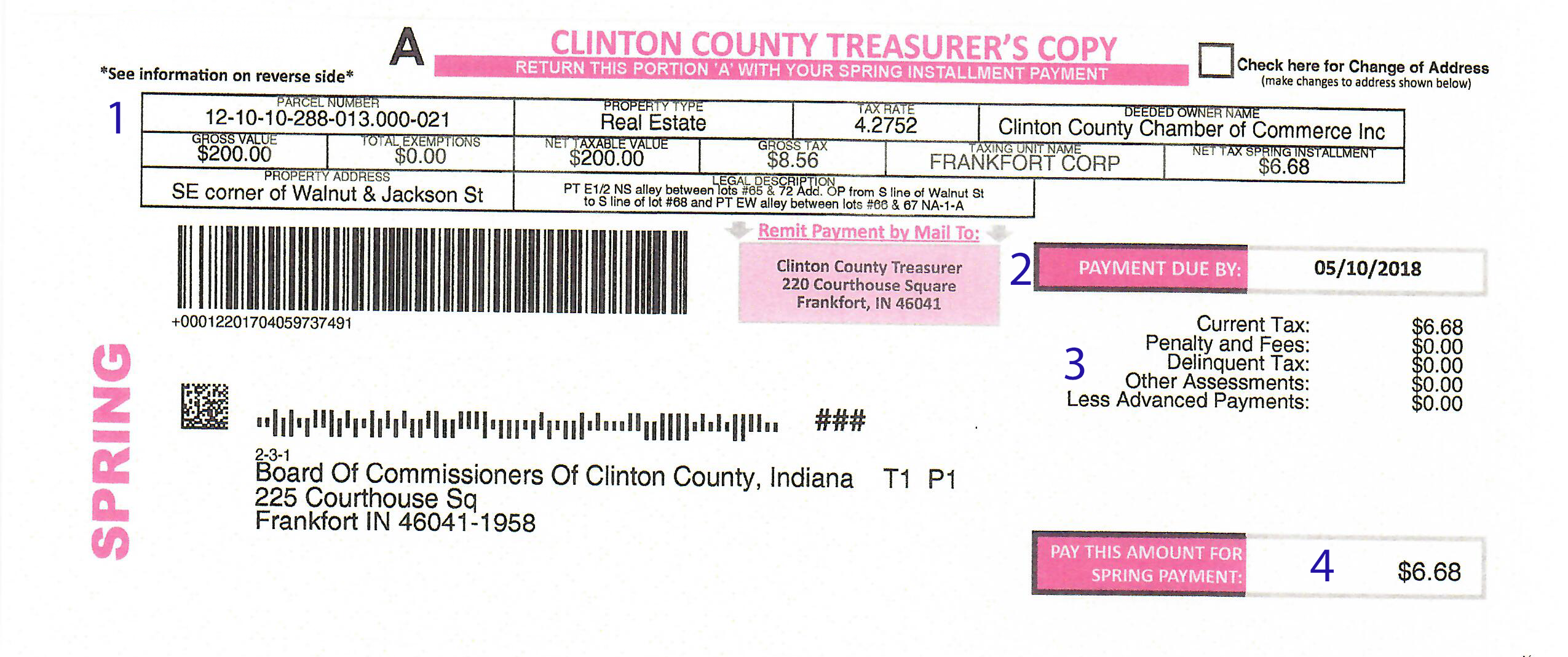

Property Tax FormSee below for clarification on reading your tax statement.

On the first page of your yearly Property Tax Statement you will find several lines of useful information. The above image highlights several portions of your bill and the details are listed here. 1. This is the State Parcel Number associated with the particular property. When referencing your property, whether at the Treasurer’s Office, Auditor’s Office, or Assessor’s Office, the State Parcel Number is the fastest way to reference the correct property. 2. The “Payment Due By” line of your Tax Bill states the last day the amount owed on the property can be paid to the Bartholomew County Treasurer’s Office before penalties will automatically be applied. 3. This portion of your tax bill contains five (5) lines, each affecting the total amount due. “Current Tax” denotes the amount of taxes the property owner is responsible for. “Penalties and Fees” refers to penalties applied for tax payments that were delinquent. Note that any payments made after April 1st will not be included on your statement. “Delinquent Tax” refers to the amount of taxes owed during previous tax years. Note that any payments made after April 1st will not be included on your statement. “Other Assessments” denotes an additional amount of money in owed. This can be for services such as drains and will be detailed on the second page of your statement if money is owed. “Less Advanced PAYMENTS” refers to payments that have been made and are credited toward the amount due. 4. The number here is the total amount of monies owed to the County with all of the adjustments preceding the number applied.

|

|

The Treasurer is an elected position and serves a four (4) year term. The primary duty of the Treasurer is that

of tax collector. In case of delinquent taxes, the sale of real property to pay for such delinquencies may be

ordered by the Treasurer. In addition to property taxes, this office also collects

excise tax from license branches, and is responsible for keeping a record of current property owners' addresses,

alcoholic beverage licenses, and mobile home moving or transfer of ownerships.

The Treasurer is an elected position and serves a four (4) year term. The primary duty of the Treasurer is that

of tax collector. In case of delinquent taxes, the sale of real property to pay for such delinquencies may be

ordered by the Treasurer. In addition to property taxes, this office also collects

excise tax from license branches, and is responsible for keeping a record of current property owners' addresses,

alcoholic beverage licenses, and mobile home moving or transfer of ownerships.